Bipartisan legislation introduced Nov. 20 would reauthorize a key tax credit supporting veteran employment and expand its reach to include currently serving military spouses as a newly recognized target group – a key addition that MOAA has been advocating for through the Military Spouse Hiring Act.

The Improve and Enhance the Work Opportunity Tax Credit Act, introduced by Sens. Bill Cassidy (R-La.) and Maggie Hassan (D-N.H.) in the Senate and Reps. Steven Horsford (D-Nev.) and Lloyd Smucker (R-Pa.) in the House, would modernize the Work Opportunity Tax Credit (WOTC), a nonrefundable tax credit employers can take for hiring target group members during the employee’s first year on the job. The program incentivizes employers to hire “job seekers who have consistently faced barriers to employment,” according to the U.S. Labor Department.

[TAKE ACTION: Support Veteran and Military Spouse Employment]

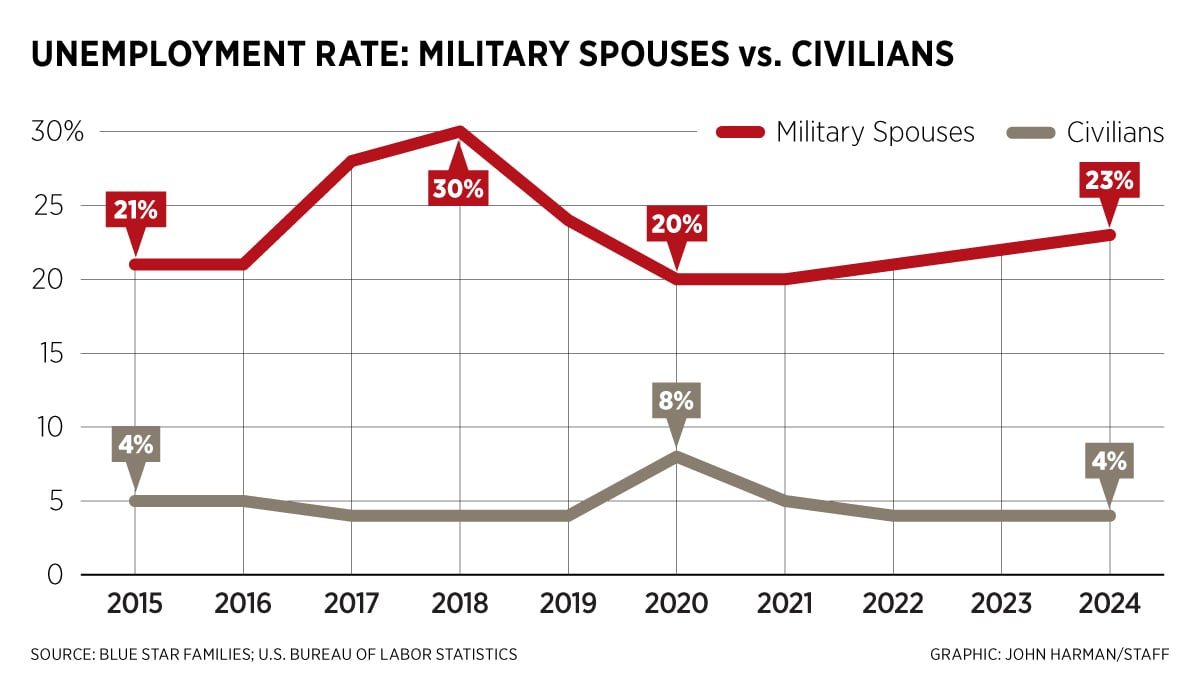

Military spouses married to active duty servicemembers have consistently faced an unemployment rate of 20% or higher over the past 10 years, a statistic detailed in both the Pentagon’s Active Duty Spouse Survey and Blue Star Families’ Military Family Lifestyle Survey. This unemployment rate is five times the national unemployment rate of U.S. civilians.

Of the 387,095 military spouses either active or looking to be active in the civilian labor force (69% of 561,008), 20% are unemployed and more than half (57%) say the pay they receive is not enough to live on. That leaves only 23% of employed spouses with a sufficient income.

More than half (51%) of active duty spouses search for employment because “my family needs the income,” according to a 2024 survey from Blue Star Families. Financial strain often forces families to explore alternatives, including leaving military service; nearly half (48.3%) of soldiers leaving service cited the impact of Army life on their significant other’s career plans and goals as contributing to their departure, Army Times reported.

When families choose to separate, it directly undermines retention and readiness, creating ripple effects across the force.

Why WOTC Matters

Frequent relocations remain a key constraint on military spouse employment, according to a 2025 study by the D’Aniello Institute for Veterans and Military Families (IVMF) at Syracuse University. Many employers use these moves to defend their decision not to hire a military spouse. Adding military spouses as a WOTC target group would allow these businesses to offset such costs via tax breaks and encourage them to tap this underutilized talent pool.

A similar approach showed positive results with veterans, who were added as a WOTC target group in 2011, when their unemployment rate was in the double digits. As of 2024, veteran unemployment is at 3.0%, lower than the national civilian average.

MOAA supports extending the WOTC program (the bill would do so through 2030) to continue this success story, and expanding the program to bring similar, positive change to the military spouse community.

Support the Improve and Enhance the Work Opportunity Tax Credit Act Today

MOAA has long championed the addition of military spouses to this program, and the Improve and Enhance the Work Opportunity Tax Credit Act would make that a reality. Contact your lawmakers today and urge them to cosponsor this bipartisan legislation to support and expand employment opportunities for veterans and military spouses.

When MOAA Speaks, Congress Listens

Learn more about MOAA’s key advocacy issues, and contact your elected officials using our messaging platform.