TAKE ACTION

Join the fight to protect your pay and benefits.

Welcome to MOAA’s COLA Watch page, where you’ll find a monthly update on the inflation figures used to set the cost-of-living adjustment (COLA) for payments received by military retirees, disabled veterans, Social Security beneficiaries, and many others receiving federal compensation.

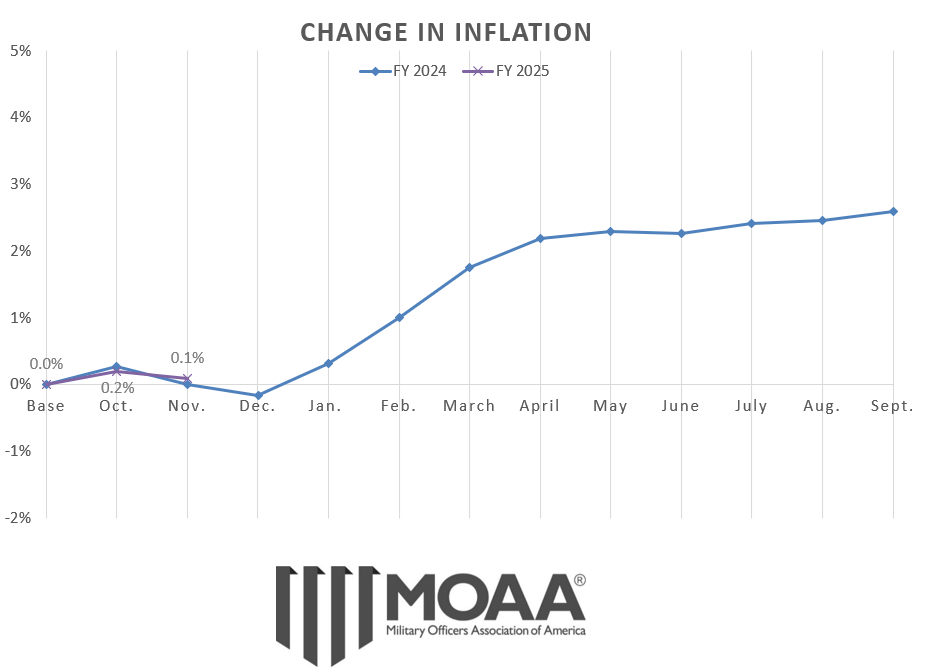

The November 2024 Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), released Dec. 11, was 308.998, 0.1% above the FY 2025 baseline of 308.729. December 2024 figures will be announced Jan. 15, 2025.

The CPI-W figures from the end of this fiscal year (July, August, and September 2025) will be compared to the FY 2025 COLA baseline to calculate the 2026 COLA (see "How Your COLA Is Calculated," below).

The September 2024 Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), released Oct. 10, was 309.046, 2.6% above the FY 2024 baseline of 301.236. This means the average CPI-W for the last three months of the fiscal year (July, August, and September 2024) is 308.729.

The baseline is subtracted from this figure, with the result divided by the baseline (and rounded to the nearest tenth), to determine the 2025 COLA of 2.5%: (308.729-301.236)/301.236 = 2.49%

For more, see "How Your COLA Is Calculated" below.

The average of the last three months of the fiscal year (308.729) will be used as the baseline to determine the 2026 COLA. The October 2024 CPI-W figure will be released Nov. 13.

The 2024 COLA is 3.2%.

The September 2023 CPI-W, released Oct. 12, was 302.257, 3.5% above the FY 2023 baseline of 291.901. The CPI-W figures from the end of the fiscal year (July, August, and September 2023) are compared to the FY 2023 COLA baseline to calculate the 2024 COLA.

The 2023 COLA was 8.7%, and the 2022 COLA was 5.9%. Aside from those adjustments, the 2024 COLA is the largest since a 3.6% increase for the 2012 calendar year.

Protecting the value of service-earned benefits has long been a pillar of MOAA’s advocacy. MOAA has led previous efforts to rebuff budget plans seeking to reduce or eliminate COLA for military retirees, many of which have taken root shortly after large increases.

The nature of a higher COLA is to preserve purchasing power for retirees, VA beneficiaries, and surviving spouses – not to fund other government programs.

[JOIN THE FIGHT: Visit MOAA’s Legislative Action Center]

The yearly cost-of-living adjustment is made by comparing the average CPI-W from monthly reports in July, August, and September of the current fiscal year to the average for the same months of the year prior. MOAA also provides a regular calculation for the monthly COLA change: (Monthly CPI-Yearly baseline CPI)/Yearly baseline CPI.

Remember, active duty pay raises are calculated differently. Learn more about CPI on the BLS web page.

Join the fight to protect your pay and benefits.