May 8, 2015

The White House supports proposals to change benefits for military survivors.

Support comes after a report made by the Military Compensation and Retirement Modernization Commission (MCRMC), a task force charged with recommending changes to military pay and benefits.

Under the MCRMC proposal, the Survivor Benefit Plan (SBP), a voluntary contribution program providing protection for military retirees’ survivors, would split into two tiers. The first tier continues the program under existing rules. A second, more expensive tier charges higher premiums and eliminates an unfair penalty that forces thousands of military survivors to forfeit their earned benefits. Retirees would have a one-year open season to make a decision on which tier to enroll.

How SBP Works

Military retirement pay ends when the servicemember dies. A large majority of military retirees are survived by their spouses, and SBP provides a way to pass on a portion of military retirement pay to survivors.

Under current law, however, military survivors forfeit part or all of their entire military SBP annuity when receiving Dependency and Indemnity Compensation (DIC) from the Department of Veterans Affairs.

The two programs are paid for very different purposes: SBP is a program administered by DoD that allows uniformed service retirees to elect coverage to provide continuing financial support for an eligible survivor. DIC is paid to survivors of servicemembers who die while on active duty, or to survivors of retirees who die of a service-connected illness.

In many cases, the offset virtually wipes out any SBP payment, leaving survivors with only DIC, a modest payment of about $15,000 a year.

When military service causes a servicemember's death, indemnity compensation from the VA should be paid in addition to SBP coverage, not subtracted from it.

Proposed Changes

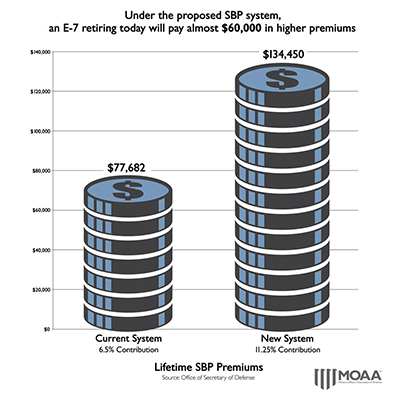

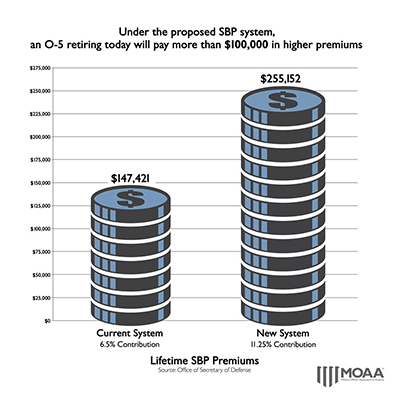

Under the current system, military retirees contribute up to 6.5 percent of retired pay to ensure their survivors receive up to 55 percent of the sponsor’s retired pay. Premiums continue until the sponsor makes 360 payments and reaches age 70. Automatic coverage is extended to survivors of servicemembers who die on duty.

The new tier increases the premium to 11.25 percent – a 73 percent increase. Survivors of retirees choosing the higher tier option will not be subjected to the SBP-DIC offset.

The change could have a significant impact on the amount of money servicemembers contribute to the program:

“The problem with this proposal is that it asks the folks who will most likely be affected by the offset, those who have significant service-connected health issues, to pay even more in premiums to take care of their loved ones,” said MOAA’s Deputy Director of Government Relations, Col. Phil Odom, USAF (Ret). “These individuals are likely to have serious issues finding gainful employment after military service. We shouldn’t be asking them to pay even more money for SBP.”

MOAA is also concerned that the new premium is likely to be seen as too expensive for servicemembers, and they may decline SBP coverage altogether. DoD and Congress have worked hard at improving SBP programs over the past 25 years. Participation is currently at record levels and no private insurance on the market can offer equal protection.

The 60,000 Survivor Question

Unfortunately, the proposed changes fail to provide relief for the 60,000 military survivors currently affected by the SBP-DIC offset. These survivors will continue to be penalized by an antiquated Civil War-era law.

“Before we move forward with changes in survivors benefits, it’s imperative that we help the most disadvantaged beneficiaries first,” said Odom.

Rep. Joe Wilson (R-S.C.) and Sen. Bill Nelson (D-Fla.) have introduced legislation to eliminate the SBP-DIC offset.

Take action: please send a MOAA-suggested message asking your legislators to support H.R. 1594 and S. 979 today.