April 10, 2015

Another group of military leaders spoke out against proposals to overhaul military pay and benefits.

In March, top military medical leaders spoke out against the Military Compensation and Retirement Modernization Commission’s (MCRMC) proposals to privatize TRICARE, citing concerns over military medical readiness.

Now, several recently retired senior enlisted advisors (SEA) have come together in a Military Time's op-ed voicing caution over retirement proposals advanced by the MCRMC. Citing their responsibility to serve as the voice for military members and their families, the SEAs warned the retirement recommendations could leave the servicemembers “shortchanged.”

One of the primary concerns with the proposal to convert troops to a 401(k)-like retirement system is the inherent shift in retirement responsibility from DoD to the servicemember. According to the article, “[i]n order to achieve the projected benefit totals in the commission's report a service member would have to make exactly the right decision at several career decision gates.”

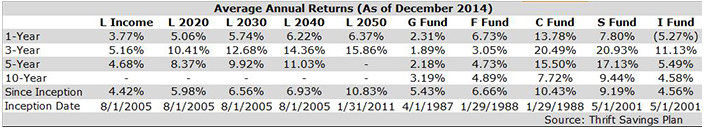

MOAA has concerns that troops might not make the correct fund selection when planning for retirement. These choices could result in drastically lower returns than what the commission projected. Few of the funds available through the Thrift Savings Plan provide the necessary returns to match the commission’s expectations.

Under the MCRMC proposal, a servicemember assumes all of the investment risk of his or her defined contribution (DC) portfolio. The value of the available benefit is dependent on the financial market, which is a stark difference from the predictable and guaranteed defined benefit (DB) plan.

For nearly 15 years, troops have faced long deployments, often back-to-back. Requiring servicemembers to plan and worry about their retirement when they should be focused on the mission generates an unnecessary burden.

Further, the likelihood of success of the MCRMC’s proposal is completely dependent on major financial literacy education of the force. By the commission’s admission, only 12 percent of servicemembers surveyed indicated they received financial information from their command or installation.

MOAA is skeptical of the services’ ability to provide sound financial counseling based on industry past practices. We also doubt whether highly qualified, government-sponsored financial planners will be available at all locations to provide continued assistance to members, retirees, and their families.

On April 7, MOAA President Vice Adm. Norb Ryan, USN (Ret) reached out to every chief of staff and military legislative assistant in both the House and Senate. He sent copies of the Military Times article along with MOAA’s new publication, "Retirement About Face?", explaining the potential downsides of converting military retirement to a 401(K) system.

MOAA believes these proposals by the MCRMC require further study. Before changing the retirement system, Congress must fully consider the second- and third-order effects on the all-volunteer force.