Is your state still fully taxing retirement pay? MOAA National serves in an advisory capacity for state-specific issues such as income tax exemption. Please contact your local MOAA council as state legislation must originate at the state level.

Military retirees in Nebraska can celebrate progress on a tax exemption two decades in the making.

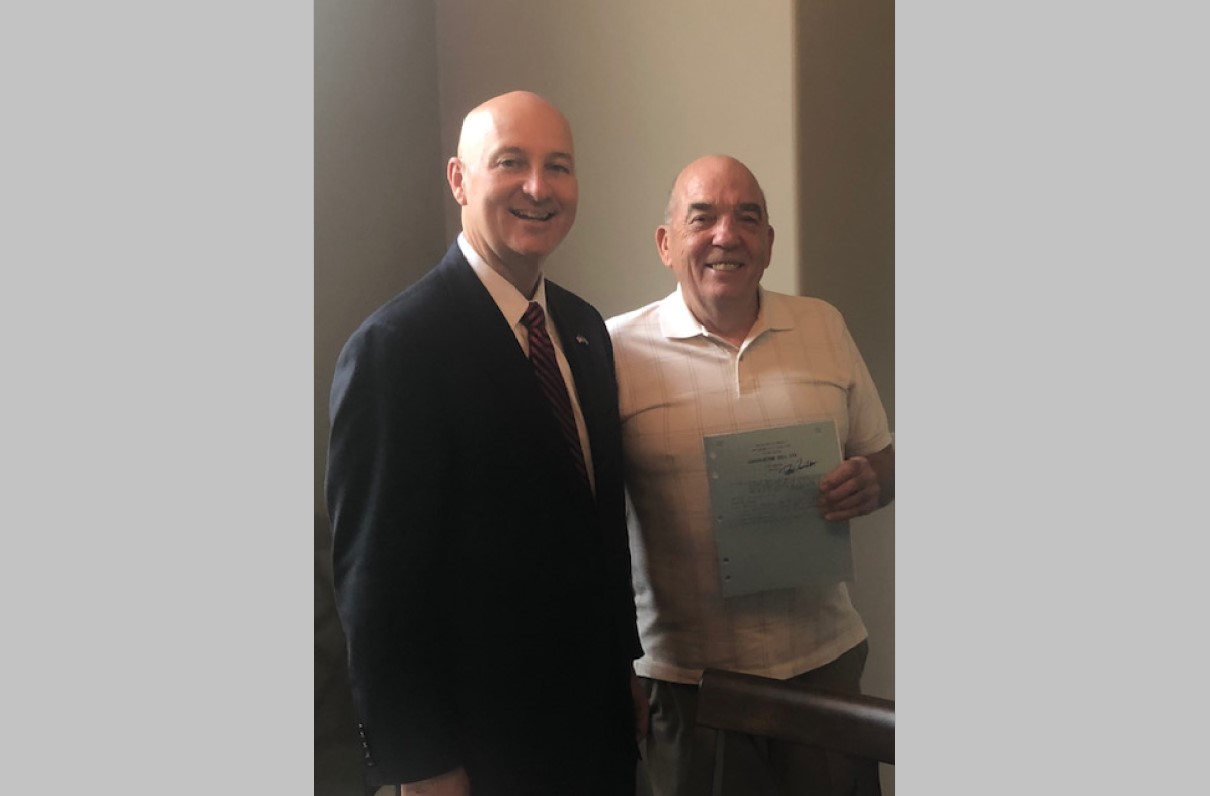

Nebraska Gov. Pete Ricketts has signed a bill that grants a 50% exemption on state income tax for military retirees. The exemption marks progress on efforts that began in 2000 with MOAA’s Heartland of America Chapter and the Nebraska Veterans Coalition.

“There is a long history of Nebraska trying to get an exemption,” said Brig. Gen. Paul Cohen, USAF (Ret), who helped work on the legislation for the Heartland of America Chapter.

MOAA worked with the coalition to talk to lawmakers about approving a tax exemption. Initially, they requested a 100% exemption that would begin in 2021, but sensed the COVID-19 pandemic would wrinkle that plan.

[DONATE NOW: MOAA's COVID-19 Relief Fund]

The state legislator session was delayed to the pandemic, and lawmakers said they would not accept any bills that would affect the 2021 budget. After a final meeting, the coalition agreed to reduce the request from a full exemption to 50% and push it back to begin in 2022.

“This is a launching pad to get something on the books,” Cohen said. “The plan was to fix it when the session came around, but along came COVID. The speaker of the legislator said he would not entertain any bills that had an effect on the budget in 2021, and I didn’t want it to die. It would have just sat there.”

The law eliminates a tax law that offered retirees from the uniformed services who retired on or after July 18, 2012, two options for a state income tax exemption: Either excluding 40% of retirement income for seven consecutive, taxable years, or excluding 15% of retirement income for all taxable years, beginning at age 67.

The law stated that the retiree would lose the ability to choose an option if he or she didn’t select one option within two years of the retirement date.

[RELATED: MOAA's Military State Report Card and Tax Guide]

Neither of those options enticed military retirees to move to (or remain in) Nebraska, Cohen said. So coalition members hit the halls of the state capitol to talk to lawmakers about exemptions.

Efforts to get an exemption date back to 2000, when MOAA members Col. Joe DeCarlo, USAF (Ret), Lt. Col. Mark Dreiling, USAF (Ret), and CW5 Dean Kenkel, USA (Ret), began researching the economic impact it could have on Nebraska.

They ramped ramped up over the last four years, but unlike other states, Nebraska has just one legislative body -- coalition members continuously found themselves pitching the exemption to new lawmakers as term limits were reached and personnel turned over.

“To say it might have been discouraging in the first years was an understatement,” Cohen said. “Just about the time you think you have a group of people in your camp, they’re gone and you’ve got to start again. Even though it’s not a full exemption, it feels good. That’s why this is so rewarding.”

The exemption better positions Nebraska to attract military retirees, as neighboring states South Dakota, Wyoming, Kansas, and Missouri already offer full exemptions on military retiree pensions. Colorado and Iowa, also neighboring states, offer partial exemptions.

Montana Update

In Montana, state legislator John Fuller introduced legislation for the 2021 session that would exempt retired military service pension from state income tax.

“I call it a Montana Workforce Development Plan because if we can encourage more retired military to retire to Montana, our economy will blossom,” Fuller said. “Retired military are relatively young, highly-skilled, internally motivated to succeed, have families, healthcare and patriotic values beneficial to Montana.”

He filed the same bill in the last legislative session, but it died in standing committee when the legislator adjourned.

CW3 Jack Babon, USA (Ret), president of Western Montana Military Officers Association chapter, said last session, members sent letters and called their representatives to urge support for the bill. He said this session, they will wait to see what legislation is filed before strategizing a plan forward, he said.

Utah Update

In Utah, Sen. Curtis Bramble and Rep. Jon Hawkins introduced legislation that would have credited a state income tax credit equal to the amount paid by in federal taxes on military retirement pay. That legislation was approved in December 2019 in a special tax restructuring session, but appealed by legislators less than a month later.

Bramble said legislators will introduce new legislation in the 2021 session pushing for a full exemption for military retirees.

“We’re going to be pushing hard for this,” he said. “We just had an interim revenue and tax committee meeting and the committee has taken up the military retiree question again, so I anticipate it’s highly likely you’ll see something coming forward.”

Bramble said he believes the exemption is an economic incentive because it will attract a population that will spend money in the community, which improves the state’s economic vitality and ultimately generates more revenue.

It will also strengthen Utah’s workforce, he said.

“Military retirees are generally well-trained,” he said. “The government makes certain our military is well-trained in whatever discipline their skill set is. When you recruit move-ins, military retirees are a very attractive demographic because they can hit the ground running. They’re ready to enter the workforce with a high-level of training.”

MOAA Knows Why You Serve

We understand the needs and concerns of military families – and we’re here to help you meet life’s challenges along the way. Join MOAA now and get the support you need.