While the 2024 cost-of-living adjustment (COLA) for military retirees, VA disability recipients, Social Security beneficiaries, and others who receive federal payments has been set, many variables obscure the future of COLA – including potential threats to the value of your earned benefit.

As we look through a lens of looming government shutdowns, skyrocketing national debt – $33.5 trillion, with the government spending $1.8 trillion more per year than it takes in – and wars in the Middle East and Eastern Europe, MOAA will keep watch on three factors affecting COLA in the coming year and beyond.

1. Budget Pressure and Congress

Ten years ago, the government came out of a 16-day government shutdown. Congress could not resolve differences regarding appropriations or even a continuing resolution to carry the government forward. The shutdown ended on Oct. 17, 2013 – but there were casualties.

The immediate challenge then before the Congress was to fund the government or risk another shutdown before Christmas. The House put COLA on the chopping block, with a reduction of 1% for all retirees before age 62 – if COLA were less than 1% it would be zeroed out, but no negative adjustments. The bill was signed into law on Dec. 26, 2013, with “COLA minus 1%” effective Dec. 1, 2015.

[RELATED: COLA Is a Battlefield]

MOAA immediately took the lead to lobby against the cut to COLA – sharing the significant impact on our servicemembers with lawmakers and the public, using as the example of an O-5 and an E-7, each with 20 years in service. The cumulative loss for the officer would have been $124,406 and the enlisted member would lose $82,982. Thankfully, that message carried the day, and the legislation overturning that provision was signed into law in February, less than three weeks from MOAA’s testimony to the Senate Armed Services Committee.

There are too many similarities between this historical, chaotic sequence of events and what we are seeing right now. And thanks to a 2022 report, there is already a prescribed path for Congress to follow if it seeks incremental savings on the backs of military retirees and other COLA beneficiaries.

Budget Pressure and the CBO

The Congressional Budget Office’s 2022 report on deficit-reduction tactics included “Use an Alternative Measure of Inflation to Index Social Security and Other Mandatory Programs” as one of its options. MOAA previously reported this option – a Consumer Price Index variant known as “Chained CPI” – would lag, on average, about one-quarter of a percentage point behind the traditional calculation using the CPI for Urban Wage Earners and Clerical Workers (CPI-W).

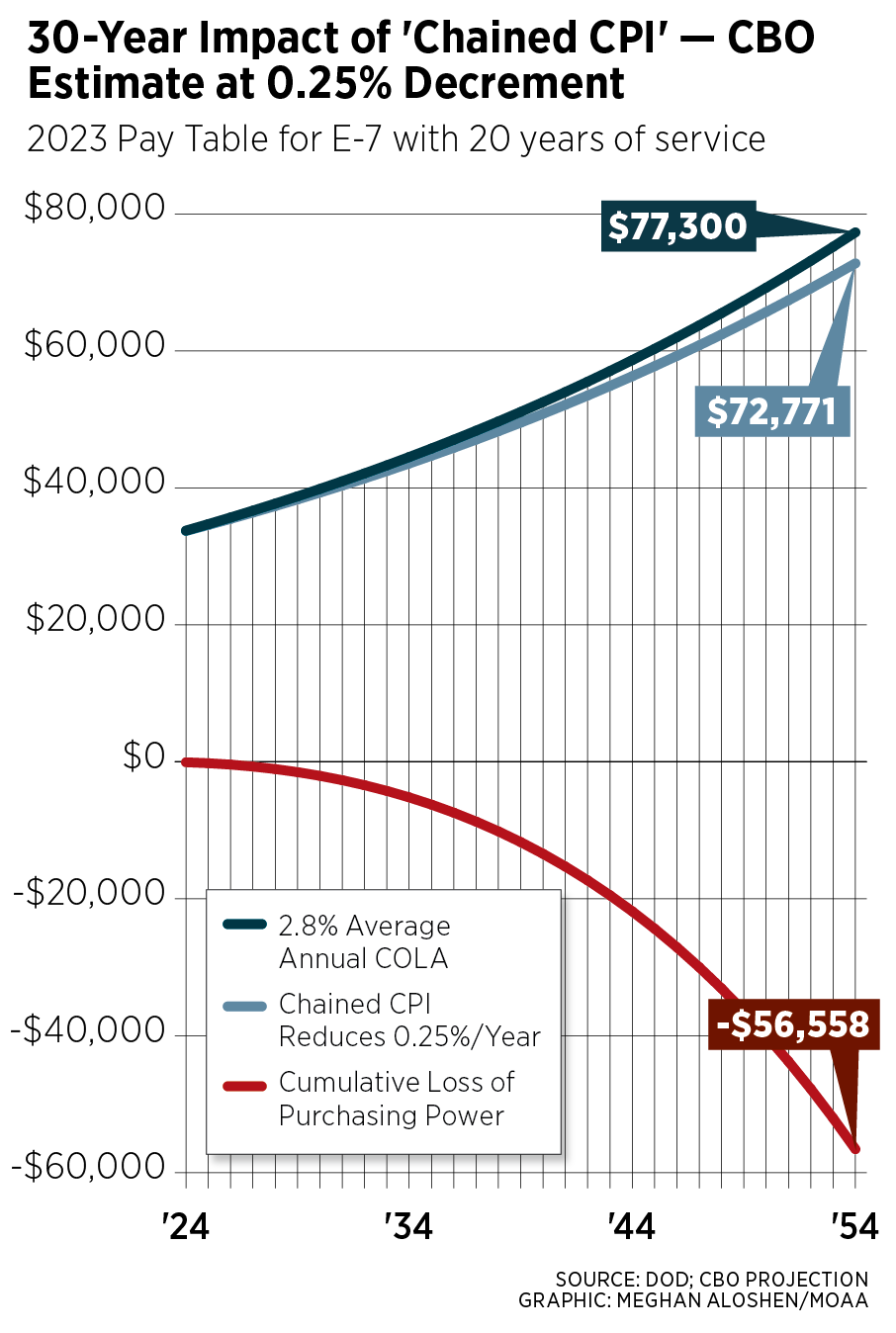

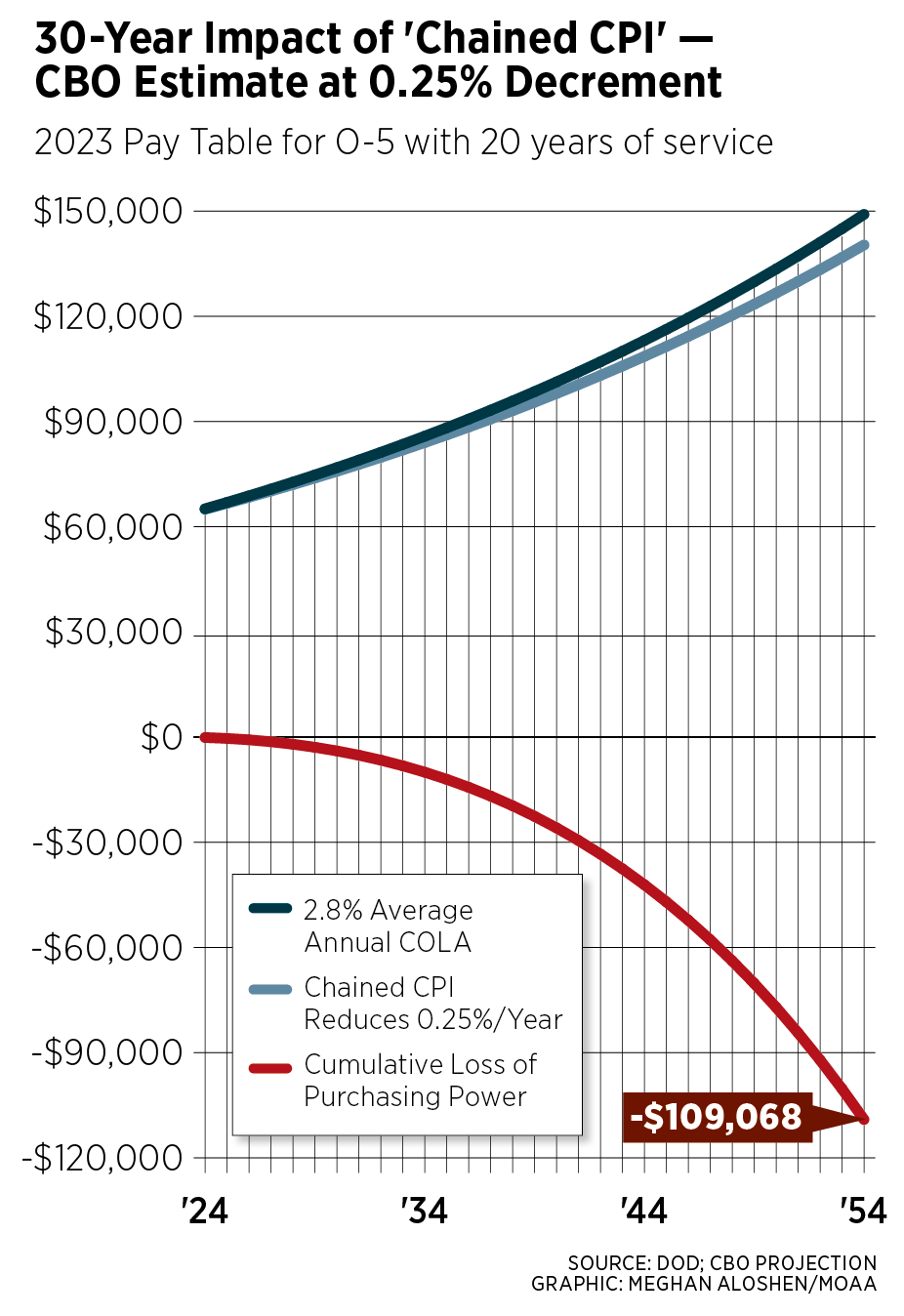

That quarter of a point seems minor, but when we look at the compounding effect over time, and with no likely retreat, the impact is remarkable. Two examples, using the 40-year average COLA (2.8%) and the 0.25 decrement noted in the CBO report, lead to a reduced COLA of 2.55%, which is rounded to 2.6% by the Bureau of Labor Statistics. The end difference of annual retirement pay in 2054 is shown at nearly a 6% loss of income:

- An E-7 retired with 20 years of service would lose nearly $57,000 over 30 years.

- An O-5 retired with 20 years of service would lose about $109,000 over 30 years.

MOAA stands ready to fight against such proposals should they become part of discussions on Capitol Hill.

3. The Fed’s Inflation Focus

Federal Reserve Chairman Jerome Powell is holding the line, seeking a 2% inflation rate. The recent monthly CPI-W update of 3.5%, averaged with the two previous months, generated a 3.2% COLA. But can the Fed really get us down to 2%?

Maybe not. While monumental strides have significantly reduced inflation, December 2022 was the last month-over-month CPI decrease. It’s been going in the wrong direction relative to the 2% target since April; see the chart at MOAA’s COLA Watch page for the latest trends.

[RELATED: MOAA’s COLA Watch]

The Fed and the six members of its Board of Governors have their hands full with maintaining strict monetary policies that may or may not reach the 2% goal. Some other indicators, like the Producer Price Index, might soften the Fed’s position, but it would take several other favorable indicators before Powell would settle on something between 2% and 3%.

A fair target for inflation could be 2.8%, the 40-year average of the annual Consumer Price Index (COLA for the same period averages 2.8%, but that is not automatic).

Understanding the Threat

We must be vigilant about all service-earned pay and entitlements, and we will need your help if they become pawns as part of lawmaker vote-gathering or wrongheaded solutions to financial problems. Stay tuned and engaged by signing up for MOAA’s Legislative Action Center.

PREMIUM Membership Comes With So Many Benefits. Are You Taking Full Advantage?

Find out just how many benefits are waiting for you, and start using them TODAY.