(This article originally appeared in the December 2022 issue of Military Officer, a magazine available to all MOAA Premium and Life members. Learn more about the magazine here; learn more about joining MOAA here.)

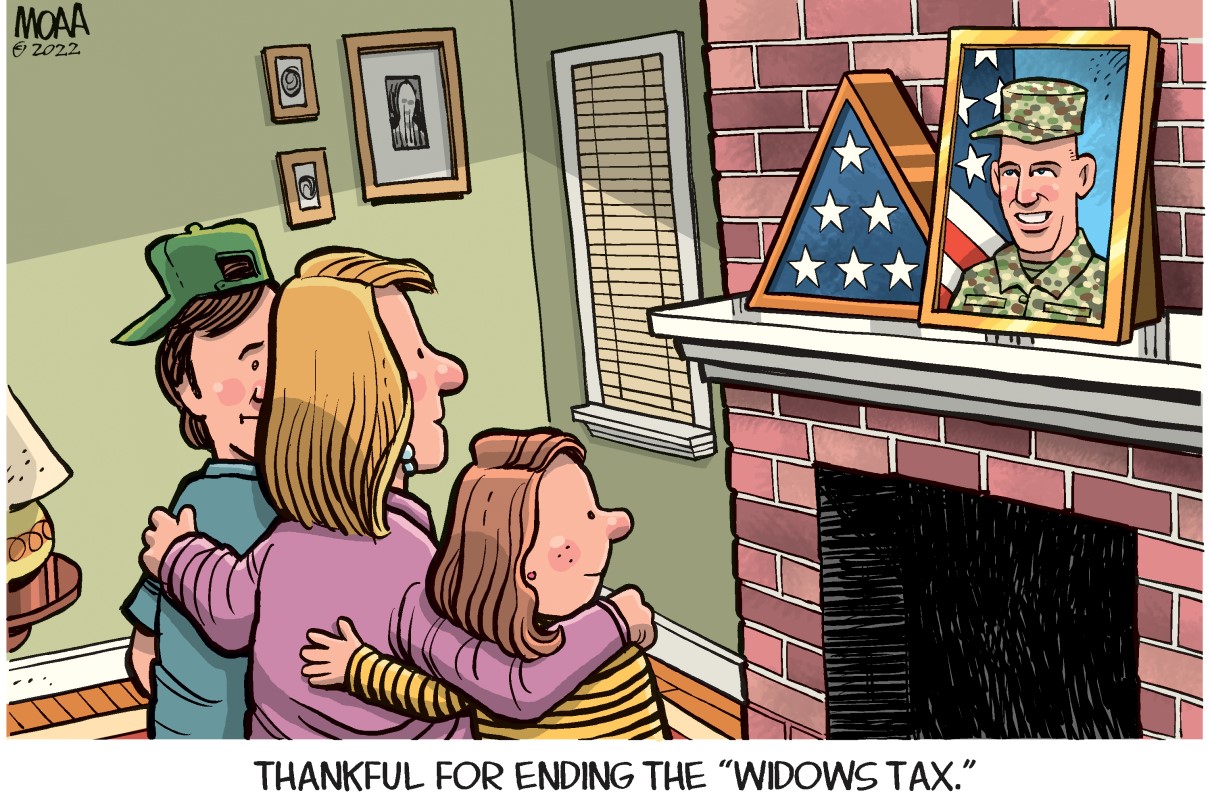

Three years ago, surviving spouses, veteran service organizations, and the entire military community were elated as the “widows tax” was repealed.

Some had been involved in advocacy efforts for decades, making countless phone calls and contending with their fair share of dashed hopes. But in 2019, bipartisan support in Congress was at its strongest, advocates unified, and the mantra “Axe the Widows Tax” filled the halls of the Capitol.

[FROM MOAA'S PRESIDENT: Reflecting on Making Widows Tax Repeal a Reality]

President Trump on Dec. 20, 2019, signed the National Defense Authorization Act and with it came a phased-in repeal of the Survivor Benefit Plan-Dependency Indemnity Compensation (SBP-DIC) offset.

Full Benefit Begins

In January, the widows tax will be fully repealed, and surviving spouses will begin receiving 100% of both their SBP and DIC benefits.

“I feel relieved. I feel that it’s almost hard to believe that it actually got changed,” said Kristy DiDomenico, a mother of two daughters, whose husband, Army Sgt. 1st Class Jason DiDomenico, died in 2018.

Kristy was among the thousands of surviving spouses who mobilized to change this unjust law. Some, like Kristy, made frequent trips to D.C. and shared their stories in the media.

“We all just worked off of each other’s energy,” she said. “We didn’t want to let anybody down.”

[FROM 2020: Hundreds Gather in Nation's Capital to Celebrate Widows Tax Repeal]

She heard about the injustice from surviving spouse Edith Smith, a Life Member of MOAA and longtime military advocate.

“I’m elated that it’s finally coming to pass,” Smith said. “I just think it restores the dignity to my husband’s service in the Marine Corps and the integrity to the benefits he earned.”

Kathy Prout, a surviving spouse and Life Member of MOAA who worked tirelessly for 14 years for this victory, is glad future survivors will never know this was a problem. But she notes there will always be work to do to assist new survivors.

“It’s not easy navigating all the DoD procedures … and grief,” she said.

[RELATED: MOAA's Surviving Spouse Corner (Updated Monthly)]

Smith encourages everyone in the military community to use your voice to protect what’s earned.

“The offset would not have been repealed without the individual participation of those surviving spouses who were affected,” she said. “Military beneficiaries have to learn to actively participate in the government they protect and defend.”

More Members Mean More Influence Over Retirement Pay, Health Care, and Family Programs

Get involved and make sure your interests are addressed. Because the larger our voice is, the greater our impact will be.