For those of you born in 1954, congratulations! You made it to Social Security’s Full Retirement Age (FRA) of 66 in 2020. After this year, FRA will increase for each birth year. People born in 1960 and later must wait until age 67 for FRA.

The Social Security retirement benefit amount will increase based on your age until you reach 70. After age 70, COLAs will be the only increases to the benefit.

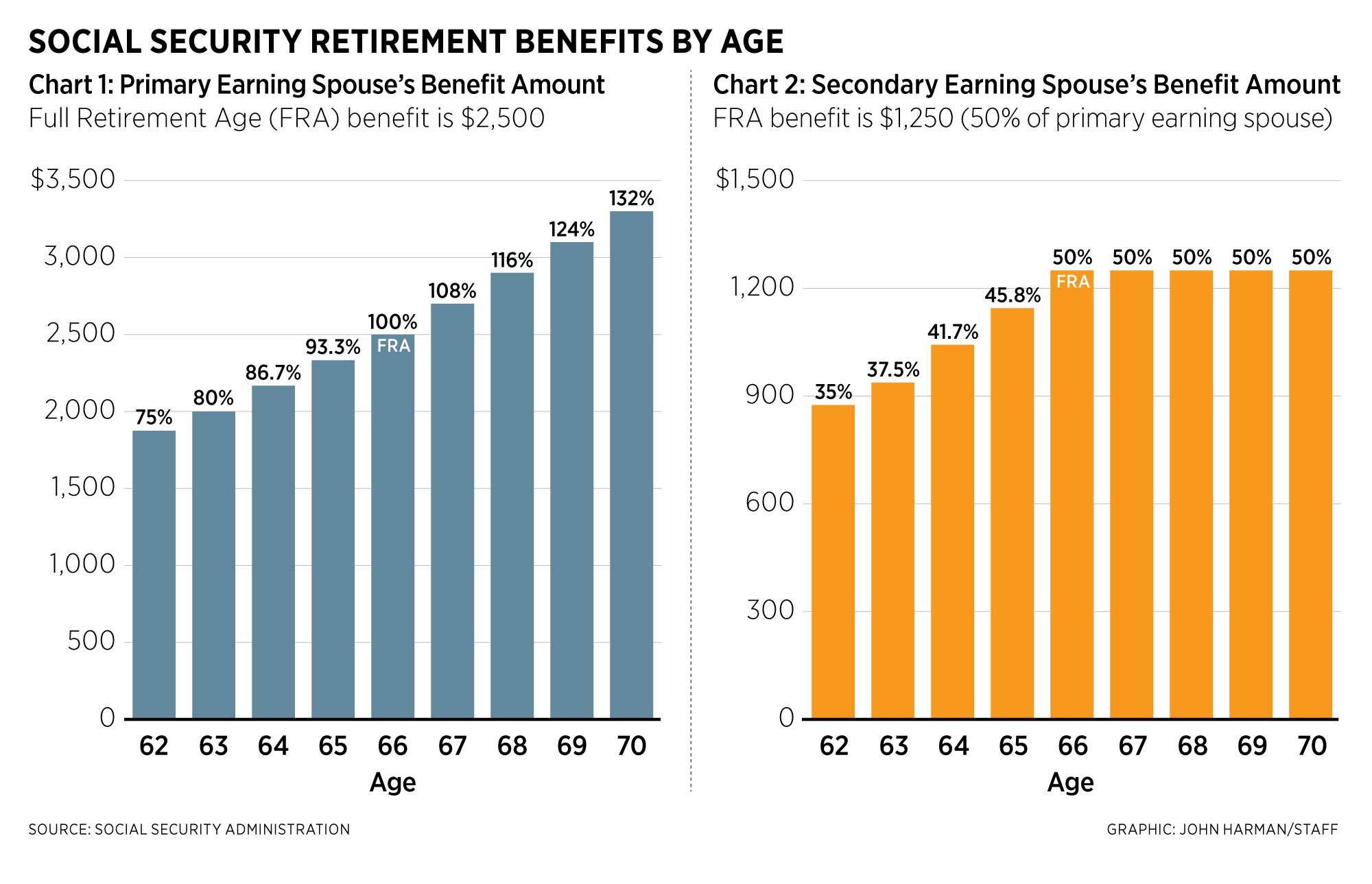

See “Chart 1: Primary Earning Spouse’s Benefit Amount” for a breakdown of retirement benefits by age. Remember to mentally separate the retirement (living) benefit from the survivor (death) benefit. “Spouse 1” will refer to the primary earning spouse. “Spouse 2” makes less money or perhaps has no income.

Usually, the decision to start the retirement benefit comes down to either needing the income or wanting it for a personal reason. Some may want to invest it. Others may plan to use it for living expenses or luxuries, thereby freeing up other sources of income.

[RELATED: More Financial News From MOAA]

Spouse 1 can increase a future Social Security survivor benefit for Spouse 2 by waiting to receive their retirement benefit.

For those who want to factor their expected longevity into the equation, the early 80s used to be a “breakeven” age at which it pays more in lifetime income to wait if you expect to live beyond this age. (Social Security did away with the breakeven point analysis back in 2008.)

Spouse 2 could have two benefit amounts if you have an earnings record: your personal earnings benefit and a spouse benefit. If both amounts are available, you are paid up to the higher amount, not two payments.

The spouse benefit is available only after Spouse 1 starts their retirement benefit.

[RELATED: Thrift Savings Plan Adds New Funds]

The spouse benefit maximum is 50% of Spouse 1’s FRA amount if you wait until your own FRA to collect your retirement benefits.

In “Chart 2: Secondary Earning Spouse’s Benefit Amount,” if Spouse 2 has a personal benefit, until Spouse 1 starts their benefit, only the personal benefit can be paid. Starting your personal benefit early, as seen in Chart 1, will also reduce the future spouse benefit, even if you start your spouse benefit at FRA or after.

If Spouse 2 was born in 1953 or earlier, the personal benefit can be delayed while receiving a spouse benefit so that the personal benefit continues to grow as in Chart 1. Younger spouses do not have this option, as starting one benefit automatically starts both benefits if both benefits are available.

If Spouse 2 is the future survivor, Spouse 2 receives Spouse 1’s retirement benefit as the survivor benefit if Spouse 2 is at FRA. Spouse 2’s personal or spouse benefit stops at Spouse 1’s death.

Ex-spouses can receive a spouse benefit from their former spouse’s benefit without waiting for the former spouse to start their benefit. This does not affect the former spouse’s benefit. As an ex-spouse, you must have been married for at least 10 years, be unmarried, and age 62 or older; your personal benefit amount must be less than the spouse benefit amount to collect the ex-spouse benefit.

Support The MOAA Foundation

Donate to help address emerging needs among currently serving and former uniformed servicemembers, retirees, and their families.