The TSP has six investment options and average 401ks have dozens. How and when do you know what to pick? How you structure an investment portfolio is critical to either wealth accumulation or preservation.

From what we hear in financial news, we are indoctrinated to think investing is risky, requires constant monitoring, and you have to buy and sell at the right times. After all, why else do we get briefed everyday on the market results? Stop listening to them and stop “playing” their game. There is no “playing” in investing.

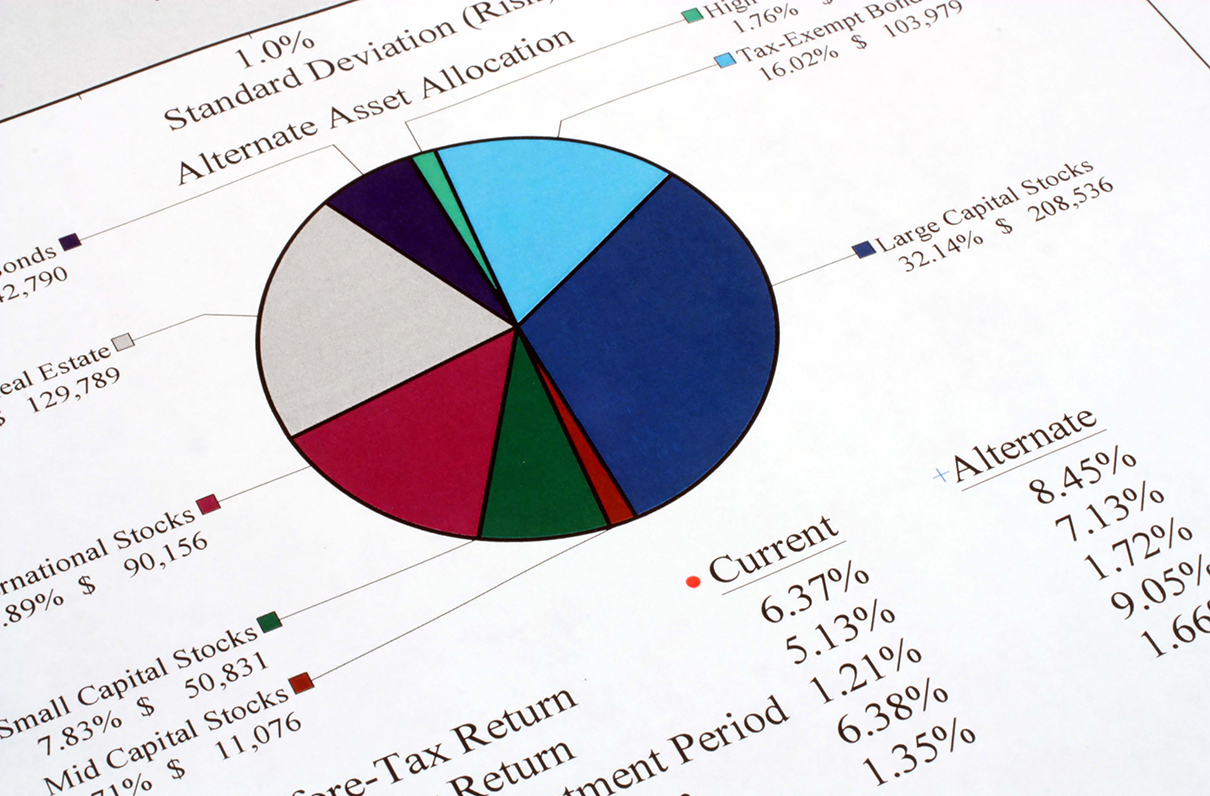

Your allocation (diversification) is the key to achieving your objectives. Your allocation is like a valve you turn to control the operation of your portfolio.

Over the history of stock markets, there are two truisms. Expect volatility (up and down movements) in the short terms. Over long terms, the stock market is permanently up. This matters.

We also know some investments move counter to the stock market. This also matters.

Let’s simplify by considering only three asset classes; stocks, bonds and cash.

- Stocks are volatile in short terms but have the greatest long-term returns; returns necessary for wealth creation.

- Bond values are relatively steady (compared to stocks) and tend to move counter to stocks, but do not provide long-term returns necessary to build the wealth required for retirement.

- Cash provides stable values but not enough return to offset taxes and inflation.

A larger proportion of stocks in the portfolio increases volatility but provides required long-term gains. A larger proportion of bonds and cash provides protection against volatility but you sacrifice long-term gains. Risk pays; safety doesn’t.

Volatility, which most consider the risk in the stock market, is our friend when used to our advantage. Read about Averaging Down at www.moaa.org/financeblog.

Put all three asset classes together and what do we have? A way to control a portfolio’s risk and returns yet still achieve the outcome you require. Set your allocation to achieve your objective and leave it alone.

If you average downin your portfolio, you want volatility to help enhance returns so a stock heavy portfolio is to your advantage.

If you don’t average down or you are near or in retirement, you are looking for a more consistent return with less volatility. A balanced portfolio with half or slightly less stocks is more your speed.

The right portfolio allocation puts you on the right track to achieve your objective without the guesswork and stress. No more playing the game or constant worry about what you should be doing. Now your portfolio works for you and not the other way around.

To learn more after this introduction, go to the link above.