Servicemembers, veterans, and their family members reported more than $414 million lost to various types of fraud last year, according to congressional testimony from the Federal Trade Commission (FTC) – that's 50% more than the previous year. So it’s no surprise several agencies, including the FTC, are making scam awareness central to their Military Consumer Month messaging this July.

The FTC’s outreach comes as state attorneys general offer similar advice to help ward off this growing financial problem. Florida officials publicized the state’s Military Consumer Protection Guide with details on spotting multiple scam types, California officials highlighted the $164 million lost by military community members to impostor scams (a target of last year’s awareness efforts), and Connecticut officials offered practical advice for reporting and avoiding fraud.

Much of the advice listed above runs parallel to materials offered by MOAA via MOAA.org and the member newsletter, which range from an in-depth series on types of fraud to materials from our partners at the Cybercrime Support Network’s Military and Veteran Program to archived webinar presentations on financial fraud, cybercrime, and similar issues (Premium or Life member login required).

[RELATED: Prevent a Future Financial Headache With These 6 Checkups]

But as the FTC pointed out in a blog post launching Military Consumer Month, “You may be able to spot a scam from a mile away, but chances are, you know someone who might not. It could be a family member, colleague, a servicemember or veteran in your life, or maybe even a battle buddy. Sharing what you know can help protect someone you know from that scam.”

Considering your own outreach, or just need a quick refresher? Consider these five tips from the above resources, as well as the Better Business Bureau (BBB):

1. Slow Down. A key factor in multiple types of scams is the need to “act now” or other language designed to encourage the victim to rush past any number of red flags. Take a break, talk to a trusted friend or financial adviser, and figure out the next step.

2. Payment Method Protocol. If you’re required to pay for anything in gift cards, cryptocurrency, or a specific payment app, it’s likely a scam. These methods can be harder to trace, making refunds next to impossible.

[REPORT: Military Community at Higher Risk of Payment App Scams]

3. Circle Back. From home loan services to investment products, veterans can be high-profile targets of all types of solicitations. Even if you think a deal could be right for you, don’t respond directly to the sales offer – take a name, a phone number, or an email address, then do follow-up research to make sure the product is legitimate.

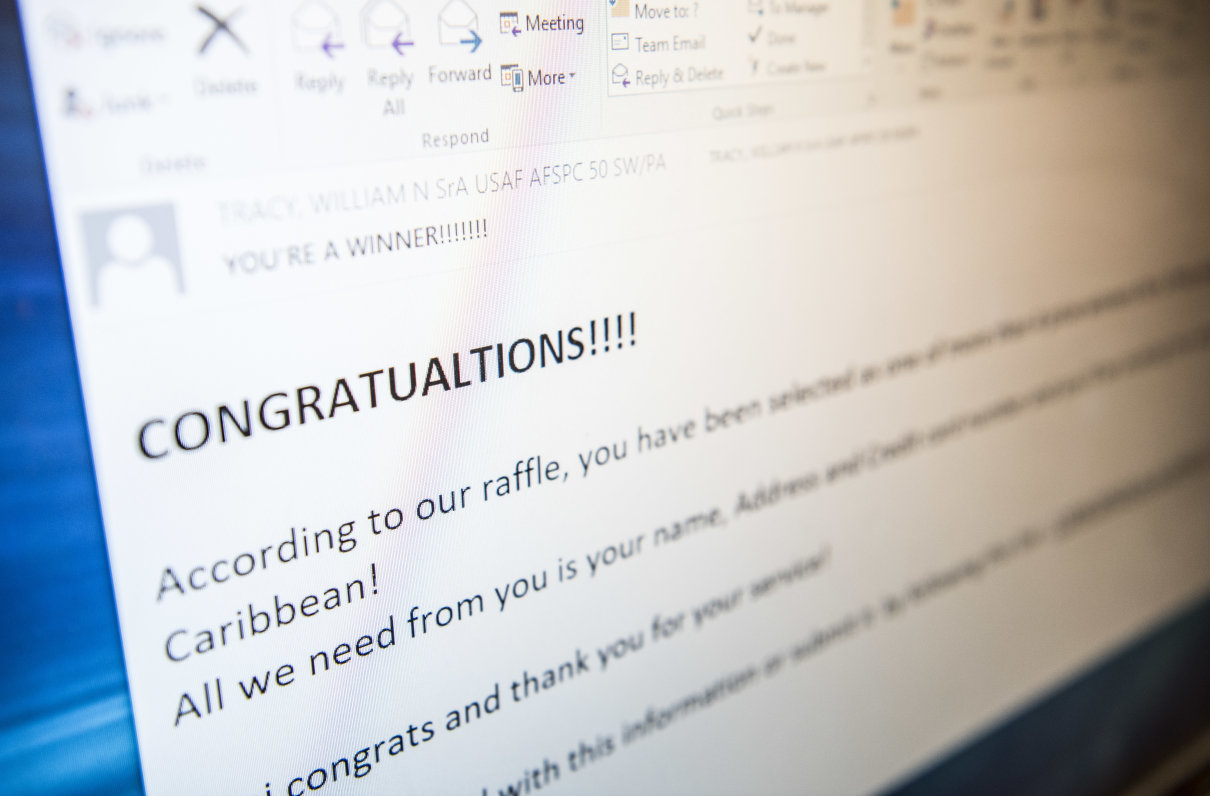

4. Don’t Click. Email scams and “phishing” tactics have become more intricate in recent years, with scammers able to make fake communications look nearly identical to the real thing. Cut out the risk by avoiding links in emails – go to the company’s homepage or your online account instead and see if the message is for real.

5. Report, Report, Report. The FTC’s fraud reporting website is a good starting point if you believe you’ve been victimized by a scam. You can also report fraud to local or state law enforcement, or to the specific government agency involved – the VA, for example, maintains its own reporting structure for benefits fraud and abuse, and the Consumer Financial Protection Bureau offers a complaint process for issues with financial products or services.

Keep Your Identity Safe With Aura

We’ve just added another new MOAA membership benefit! Save up to 75% on identity theft protection with Aura.