A note from Lt. Col. Shane Ostrom, USAF (Ret), CFP®, MOAA program director, financial and benefits education/counseling: MOAA hears from many members about their financial situations, and while we cannot offer personal financial advice or planning, we try to help with their understanding of financial issues or with their consumer advice needs. The following article (and graphics) by C. Vaughan – a retired Navy captain, recently retired federal employee, and Life Member of MOAA – expounds on an important lesson we explain in many MOAA finance articles and publications.

In her recent article on the Thrift Savings Plan (TSP), Kimberly Lankford noted the TSP has always been a valuable benefit for military members. The TSP has also been a valuable benefit for federal civil service employees under the Federal Employees Retirement System (FERS), enabling federal civil service employees to use the TSP to save for retirement.

FEDweek reported in January 2021 that there were 75,420 TSP account holders with assets greater than $1 million; I’m one of them, and I’d like to share with you my story and some of my lessons learned.

Although I invested in the TSP as a civilian civil service employee, I believe that my experiences are applicable to military personnel who are also investing in the TSP.

Background

I left active duty Navy service in October 1987 and began working as a Department of the Navy civilian employee under FERS. I made my first TSP contribution in the amount of $148.08 on July 22, 1988; at that time, I contributed 5% to take advantage of the government’s matching contributions.

I was, at the time, a GS-11 making about $40,000 a year, married with a wife and two young children. My wife and I thought it was important to invest for the future, so I invested 5% of my pay into the TSP. I continued investing in the TSP every payday until my final contribution on Jan. 8, 2021, in the amount of $205.34 – again, 5% of my salary.

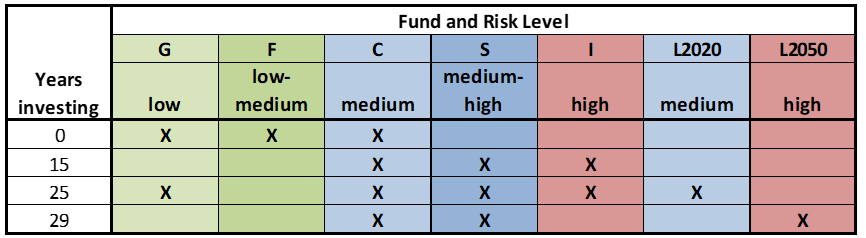

In 2003 or 2004 (after investing for about 15 years) I made two important changes to my investment strategy to increase my prospects of retiring with at least $1 million in my TSP. First, I increased my contribution percentage from 5% to 11%, and second, I changed my investments from low and medium financial risk investments (G, F, and C funds) to medium to high financial risk investments (C, S, and I funds) as shown in the table below (an “X” indicates where I was invested in at that time):

Click here to see the chart in a new window.

Ten years later, I added the G fund back into my portfolio and added one of the Lifecycle funds, the L2020 fund. Four years later, I revised my portfolio for the final time as shown in the table.

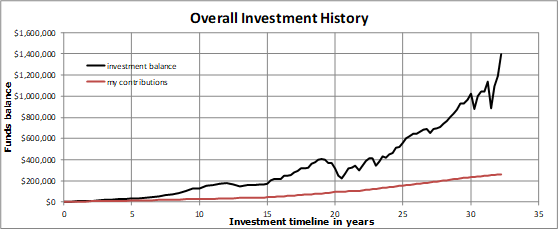

I invested in the TSP continuously for 32½ years. My TSP performance is shown in the graph below, with the black line showing my TSP portfolio value versus years of investing.

It took me 30 years to obtain a portfolio of $1 million. The growth between years 25 and 30 was phenomenal; my portfolio increased in value from $600,000 to $1,000,000 over a period of 5 years. The graph also shows my cumulative contributions to the TSP; over a period of 32½ years, I invested approximately $260,000 while my portfolio grew to almost $1.4 million.

Click here to see the graph in a new window.

Financial Risk

I previously mentioned financial risk and changing my investments to those with higher financial risk. Investing your money in a bank or credit union has very low financial risk because your funds are insured by the Federal Deposit Insurance Corporation (FDIC). Different TSP funds have different financial risks associated with them. I increased my financial risk at Year 15, when I moved funds to medium and high risk funds with the result that at Year 19 I began to lose money in my investments. But that was a risk I was willing to take because there was a chance I could also experience great returns with these medium and high risk funds.

Lessons Learned

What lessons can I pass along?

First, realize that becoming a millionaire with the TSP takes time. An article by Lyn Alden in FEDweek notes that the average contribution years of a TSP millionaire is over 29 years. Your investments will grow, but it will take time for your investments to reach $1 million.

Second, don’t overreact when the market doesn’t do what you think it should do. You can see from my graph that there were times I lost money in my investments. Around the 20-year point, for example, you can see I lost almost one-half of my investment but I did not change my investments or pull out of the TSP.

Third, when I did switch my mixture of funds at Year 15, my portfolio began to grow. I don’t have data to show what would have happened if I had not changed my fund mix at that time, but I suspect the growth would have stayed flat like it had been previous to that time.

Fourth, as my tolerance for financial risk changed, I changed my mix of funds I was investing in.

Finally, as noted by others, becoming a TSP millionaire is simple. Invest every payday and watch your portfolio grow. Evaluate your financial risk tolerance and accept the highest financial risk you are comfortable with and stay invested in the TSP.

In Summary

As a FERS retiree I have my FERS pension, Social Security, and a sizeable retirement nest egg in the TSP. Military personnel who serve and eventually retire with a military pension will also have a pension, Social Security, and can have a sizeable retirement nest egg with the TSP.

My advice to those still investing in the TSP, and especially to those who are eligible but are not investing in the TSP, is to evaluate your financial risk tolerance and accept the greatest amount of risk you are comfortable with. To make some serious money with the TSP, you need to accept the most financial risk you can tolerate.

Support The MOAA Foundation

Donate to help address emerging needs among currently serving and former uniformed servicemembers, retirees, and their families.