By Kathie Rowell

Col. Monti Zimmerman, USA (Ret), is described as “fearless” by those who work with him on legislative issues that advance military initiatives in Virginia, including spearheading MOAA efforts to reduce the state income tax burden paid by Virginia military retirees.

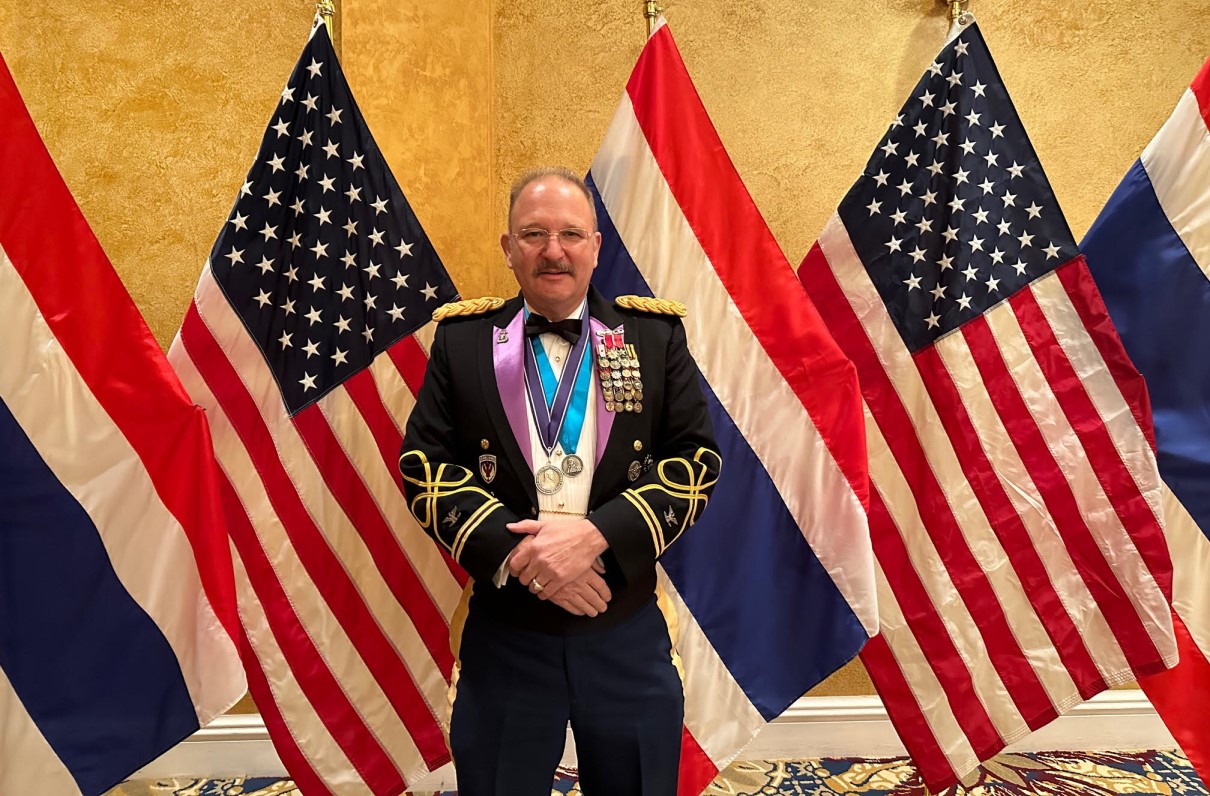

For his doggedness and results, Zimmerman has been named the 2023 recipient of the Colonel Steve Strobridge Legislative Award at the council level.

Among his volunteer roles are serving as the Virginia Council of Chapters third vice president and legislative affairs chair, and as vice chair of the Virginia Joint Leadership Council of Veterans Organizations (JLC), a governor-appointed board that encompasses 25 veteran service organizations.

Zimmerman retired from the military in 2016 after a 30-year career that took him from the Air Force to the Army National Guard and the Army Reserve. He deployed to Bosnia and Afghanistan, where he rode horses with special operations forces and worked with the two warlords who are portrayed in the movie 12 Strong.

A Life Member of MOAA, he attended a MOAA retiree appreciation event and was asked to participate in the Northern Virginia Chapter of the Virginia Council of Chapters. He decided to focus on state legislation.

[GET INVOLVED: Find a MOAA Chapter | MOAA Virtual Chapters]

“Most people don't understand how their state legislatures work and then don't understand how to actually properly advocate to make an impact or a difference,” he said. “I determined that I can make a greater impact working on the state of Virginia than I could working on federal legislation.”

His leadership in an effort to reduce state income taxes paid by Virginia military retirees resulted in the passing of a tax deduction for the first $10,000 of their retired pay for 2022 with an increase to $20,000 for 2023 and an additional $10,000 for each of the next two years. The tax break starts at age 55, but Zimmerman is actively engaging legislators to remove the starting age and to include retired members of the U.S. Public Health Service and NOAA.

[RELATED: MOAA's Military State Report Card and Tax Guide]

An issue Zimmerman has become passionate about is providing surviving spouses of those who died on active duty, not killed by enemy, with the same accrued benefits as those killed by enemy.

“In Department of Defense actuaries, those two groups are treated identical, but as far as state benefits accrual, some states treat them as polar opposites, so killed by enemy get all these benefits; died on active duty get nothing.”

He’s been shepherding an initiative that would provide property tax relief for surviving spouses of those who died on active duty and expects a constitutional amendment eliminating the disparity will be included on the November 2024 Virginia general ballot.

National Guard Maj. Kevin Hoffman, JLC chairman, worked with Zimmerman to rectify pay scale inequities for Virginia Guard members and to make needed changes to a tuition assistance program.

He describes Zimmerman as fearless.

“He will go up to any legislator at any time, at any place and talk to him or her about whatever MOAA or JLC or Guard Association issue is in his mind at the time. He will be talking and he'll be engaging and he'll gain support. It's remarkable.”

Kathie Rowell is a writer based in Louisiana.

Want to Help Servicemembers in Your Community?

Learn how you can make a difference with your local chapter.