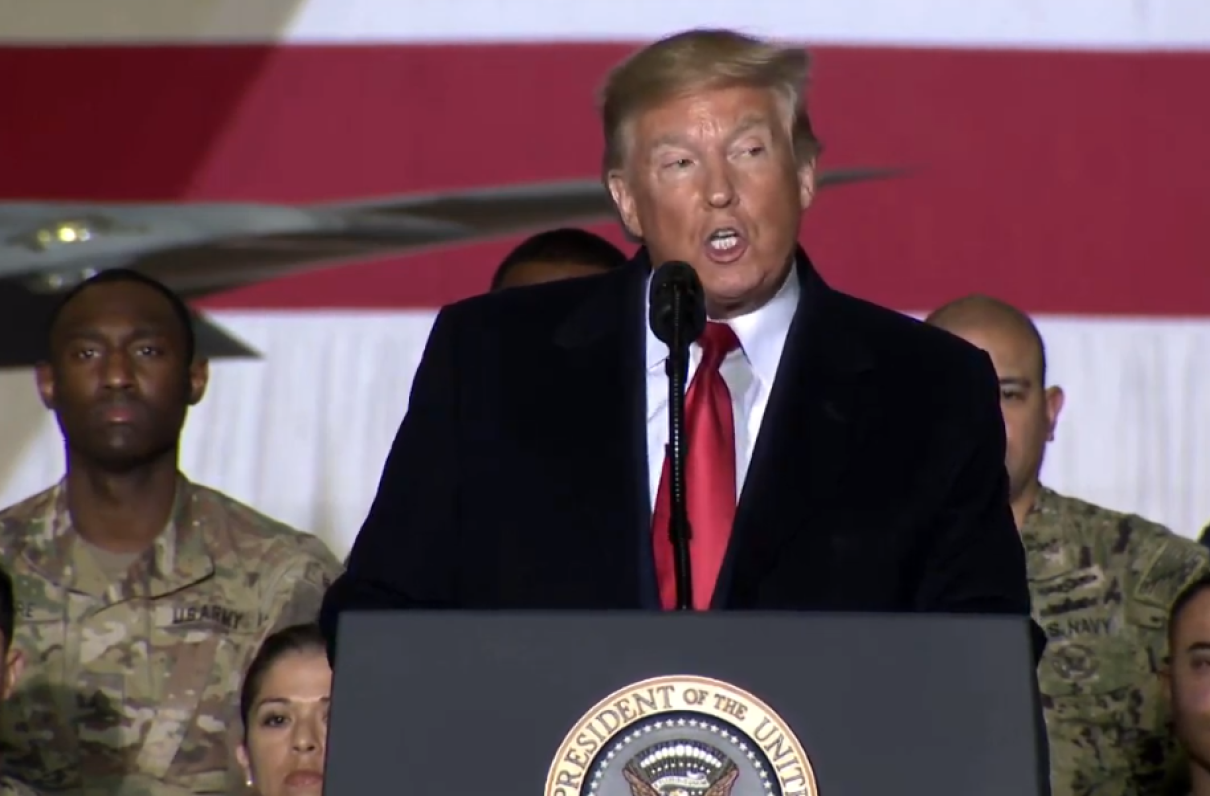

President Donald Trump signed the FY 2020 National Defense Authorization Act (NDAA) on Dec. 20 in a ceremony at Joint Base Andrews, Md. This landmark legislation culminates the many efforts ranging from grassroots visits at home to coordinated campaigns on Capitol Hill over a period of time ranging from months to decades.

MOAA’s Storming the Hill in April, and the Summer Storm in August, were instrumental in increasing awareness and support for the military pay raise, repeal of the “widows tax,” and protecting TRICARE and military medicine. The NDAA represented success in all of these advocacy priorities.

[RELATED: 'We Did It': Military Widows, Supporters Celebrate After Senate NDAA Vote]

These engagements and achievements led to MOAA being recognized for the 13th year in a row as a top lobbyist by The Hill, a news outlet based in Washington D.C.

Here’s what’s included in the NDAA, and a look at these critical issues moving forward:

Pay Raise

What’s In: A 3.1% raise effective Jan. 1, 2020. The raise matches the administration’s request and is the largest pay increase for troops in 10 years. A 3.1% increase equates to an annual raise of $1,200 for an O-3 with 10 years of service.

What’s Next: MOAA will again start working to ensure the president’s budget for the next fiscal year includes a pay raise based on the Employment Cost Index (ECI) report from October 2019. Based on that figure, next year’s raise should be 3.0%.

TRICARE

What’s In: Congress approved no new fees or pharmacy increases in 2020. Previously agreed upon increases for medical and pharmacy copays will take effect in January 2020.

What’s Next: MOAA will continue to lobby against any disproportional fee increases that may exceed cost-of-living adjustments.

[RELATED: MOAA’s COLA Watch]

Medical Billets

What’s In: MOAA’s extensive efforts on the medical billet reduction issue paid off with a provision that addresses concerns regarding both medical readiness and beneficiary access to high quality care.

What’s Next: The provision prohibits DoD and the services from reducing medical end strength authorizations until they complete a series of steps. MOAA will monitor and ensure DoD performs the following:

- A review of medical manpower requirements of each military department under all national defense strategy scenarios.

- An analysis of affected billets together with mitigation plans to address potential gaps in health care services.

- The creation of metrics to determine TRICARE network adequacy.

- The establishment of outreach plans for affected beneficiaries, including transition plans for continuity of health care services.

[RELATED: Final NDAA Would Halt Military Medical Billet Reductions]

Survivor Benefits

What’s In: After nearly 50 years, MOAA’s efforts and the efforts of others finally paid off with the elimination of a financial penalty more than 65,000 military survivors face, known as the “widows tax.” Eliminating the widows tax has been a top legislative priority for MOAA for decades.

Earlier this year, more than 150 members from around the country came to Washington, D.C. to participate in MOAA’s annual Storming the Hill event. One of the main topics MOAA members raised with their elected officials was eliminating the widows tax.

What’s Next: According to the legislation, the offset will be phased out over a three-year period in this fashion:

- 2020: No changes. Current Special Survivor Indemnity Allowance (SSIA) and all current Survivor Benefit Plan-Dependency and Indemnity Compensation (SBP-DIC) offsets remain in place. MOAA will continue to follow the evolution of directives which will support the implementation and ultimate completion of this repeal.

- 2021: The SBP-DIC offset is reduced by one third. Annuitants will receive the amount that would exceed two-thirds of the Dependency and Indemnity Compensation.

- 2022: The SBP-DIC offset is reduced by two-thirds. Annuitants will receive the amount that would exceed one-third of the Dependency and Indemnity Compensation.

- 2023: The SBP-DIC offset is eliminated. Annuitants will receive the full amounts of both SBP and DIC. Further, on Jan. 1, 2023, survivor benefit eligibility is restored to those who previously elected to transfer payment of their annuity to a surviving child or children.

Guard and Reserve

What’s In: For those National Guard and Reserve servicemembers who served on 12304B orders, such service will now count toward their active duty time to lower the age when they receive their retirement pay.

What’s Next: MOAA will continue to work to identify and correct inequities in service and benefits borne by servicemembers and their families in the Guard and Reserve. MOAA recently engaged the Defense Finance and Accounting Service (DFAS) to address the inordinate delay for retiring reservists – many routinely having to wait over 6 months to receive their retirement pay. Additionally, MOAA will continue to seek a standardized service record for members of the reserve component.

[RELATED: Frustrated With DFAS? Here’s How to Tell Your Story]

Medical Malpractice

What’s In: To address non-combat related military medical malpractice, the NDAA directs DoD to develop a regulation for negligent malpractice to be addressed through the military legal system. Although this is not a repeal of the 1950s era “Feres Doctrine,” it provides a framework of redress for servicemembers who have suffered from medical malpractice. The NDAA authorizes a payment up to $100,000 by DoD judges and higher amounts by the Department of the Treasury.

What’s Next: MOAA will monitor implementation and ensure our members and prospects understand the procedures and policies to be written in support of this legislation.

[RELATED: MOAA Supports Bill That Would Allow Servicemembers to Sue Over Military Medical Malpractice]

Spouse and Family

What’s In: After identifying significant health and safety concerns in military housing, MOAA elevated these issues to DoD and Congress, culminating with congressional hearing that built the foundation of legislation to direct improvements. This bill underwrites the most comprehensive military housing reform since 1996.

[RELATED: 4 Key NDAA Provisions, Backed by MOAA, That Will Improve Military Housing]

What’s Next: MOAA will watch closely the implementation of this housing reform to ensure the results follow the rigorous efforts leading to the bill, ensuring compliance with the following legislated actions:

- Establish a tenant bill of rights and responsibilities.

- Ensure medical costs and relocation expenses are covered by landlords.

- Formalize a dispute resolution process.

- Ensures a proper work order system and complaint database are in place along with a number of other provisions correcting gaps and negligence in the Military Housing Privatization Initiative (MHPI) system.

- Expand direct hire authority for DoD for child care providers. Additionally, take a closer look at the capacity of child care centers on post and streamline hiring to ensure they are properly staffed.

The bill also expands spouse employment resources, such as an increase to $1,000 for licensure reimbursement as well as expansions to the My Career Advancement Account (MyCAA) program for any degree area and to include Coast Guard spouses.

This defense bill is a big win for servicemembers and their families. MOAA thanks Congress for its bipartisan work, and President Trump for endorsing the legislation and extending our nation’s streak of producing a defense bill to 59 years.