April 30, 2018

MOAA members recently stormed Capitol Hill, rallying lawmakers to resolve a long-standing challenge regarding military medical retirees and their retired pay.

We were on a mission to draw attention to the roughly 200,000 Chapter 61 retirees who were unable to finish out their military careers due to injury or illness. Those servicemembers are forced to relinquish retirement pay dollar-for-dollar to receive VA disability compensation. Sometimes, that offset leaves a Chapter 61 retiree without any of his or her retirement pay.

MOAA believes all servicemembers should receive both retirement and disability compensation.

There are two bills in Congress that address gaps in Concurrent Retirement Disability Pay (CRDP): H.R. 333 and H.R. 303. One of the most common questions we faced from members of Congress and staffers concerned the difference between the two. Here are the key differences worth outlining:

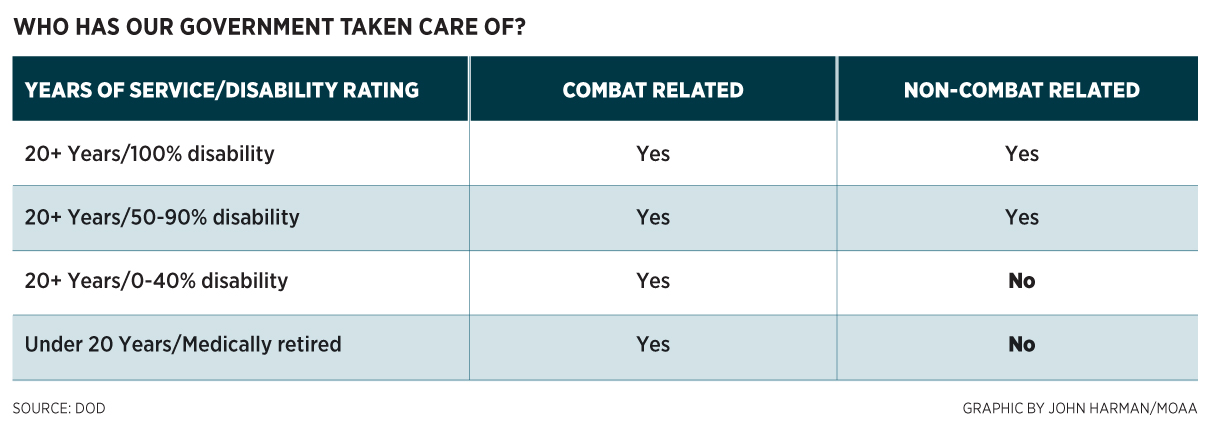

H.R. 333 is the Disabled Veterans Tax Termination Act, sponsored by Rep. Sanford Bishop Jr. (D-Ga.) It recognizes both of the two remaining categories of individuals who do not fully receive their earned retirement and disability pays: 1) retirees with 20-plus years of service and disability ratings of 40 percent or below and 2) medical retirees with less than 20 years of service and disability ratings of 30 percent or higher (also known as Chapter 61 retirees).

H.R. 303 is the Retired Pay Restoration Act, sponsored by Rep. Gus Bilirakis (R-Fla.). This bill only recognizes one of those categories: retirees with 20-plus years of service and disability ratings of 40 percent or below.

This chart indicates which categories Congress has or has not approved:

Individuals with 20 or more years of service likely will favor H.R. 303, as it directly affects them. Given its limited scope, this bill also has a likelier chance of getting passed, because the associated costs are lower than if a wider group were included.

Individuals who were unable to complete their 20 years of service due to injury or illness are retirees by most other accounts, and the reason for their early retirement was considered by their service to be within the line of duty. The only option on the table for these Chapter 61 retirees is H.R. 333.

Between the two, who is losing the most? The potential for the largest losses come from Chapter 61 retirees. Below are calculations using the same family profile with different disability rates to show the scale of loss (remember, those with 20-plus years of service with 50-percent or more disability already receive CRDP):

20+ years and 40% disability rating from the VA (highest disability not receiving CRDP): Rank is not relevant. With a spouse and three kids, including one over 18 years old and in school, the amount of retired pay lost to offset the VA disability pay is $714.90 + $32.00 + $106, or $852.90.

Chapter 61 retiree with 100-percent disability rating from VA (highest disability not receiving CRDP): An E-7 with 16 years of service, with a spouse and three kids, including one over 18 years old and in school will receive $3,261.13 + $82.38 + $266.13 = $3,609.61 in disability pay from the VA - at the price of losing their service-earned retirement pay: (2.5% x 16 years) = 40% x $4,493.10 = $1,797.24, lost to partially offset their VA disability pay.

MOAA favors H.R. 333 because it encompasses both communities we support. Our objective is to garner enough support on Capitol Hill to move the bill out of the Military Personnel Subcommittee to the House Armed Services Committee for possible inclusion in the FY 2019 defense authorization bill. Once it's in the authorization bill, the legislation can be shaped through markups or in the Conference Committee into something that will suit either, both, or some portion of the two communities who eagerly await some kind of successful outcome.

We need you to help move this bill along. The timing could not be more critical as the House Armed Services Committee gears up for its 2019 defense spending bill markup. Please send this message to your legislators.